| |

|

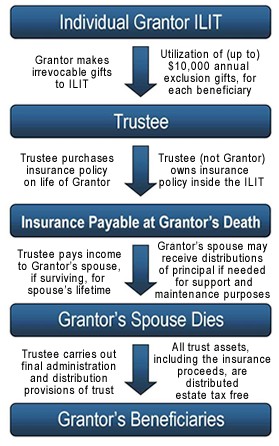

The Married Person Income ILIT is a Sole-Grantor Irrevocable Life Insurance Trust (ILIT) designed for a married individual.

|

|

It provides all of the features and benefits of the previously listed ILIT Product #07 but with one significant variation.

|

|

This format, and supporting documentation, allows for a surviving spouse of the grantor to receive all distributable net income from the proceeds of the life insurance policy after the grantorís decease for her lifetime, without the proceeds being in her estate for tax purposes at her decease.

|

|

At the decease of the grantorís spouse, or at grantorís decease if spouse does not survive grantor, the remaining principal of the trust will be distributed to grantorís heirs, free of estate tax.

|

|

|

|

|

|

|

|