| |

|

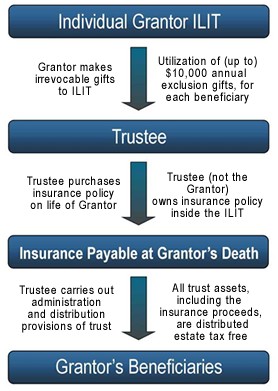

At the death of the grantor, the trustee can distribute the proceeds of the policy, as per the provisions of the trust, immediately after receiving the payout of the policy.

|

|

The trustee can hold the proceeds in-trust for a period of time, if so stipulated in the trust draft, much like the distribution options of a RLT.

|

|

If this particular ILIT format is to be established by a married person, then it is imperative that no benefits of the principal of this trust be available to the grantor’s spouse – otherwise the insurance proceeds will be in the spouse’s estate for transfer tax purposes.

|

|

|

|

|

|

|

|